The law of demand is an economic law, which states that consumers buy more of a good when its price decreases and less when its price increases (ceteris paribus).

http://en.wikipedia.org/wiki/Law_of_demand

2012年5月31日木曜日

2012年5月29日火曜日

Compensating Variation/ Equivalent Variation

Compensating Variation

u0=V(p1, w - CV)

Equivalent Variation

u1=V(p0, w + EV)

u0=V(p1, w - CV)

Equivalent Variation

u1=V(p0, w + EV)

2012年5月28日月曜日

Marginal Utility of Income

Claim: Lagrange multiplier λ is marginal utility of income.

Proof:

Indirect utility function:

Taking derivatives with respect to w, we have

Since

(First order condition) and

(Engel aggregation), we have

http://mediaislandr.org/pdf/static_optimization.pdf

Proof:

Indirect utility function:

Taking derivatives with respect to w, we have

Since

(First order condition) and

(Engel aggregation), we have

http://mediaislandr.org/pdf/static_optimization.pdf

2012年5月26日土曜日

Perfect Competition

Perfect competition describes markets such that no participants are large enough to have the market power to set the price of a homogeneous product.

Generally, a perfectly competitive market exists when every participant is a "price taker", and no participant influences the price of the product it buys or sells. Specific characteristics may include:

1. Infinite buyers and sellers – Infinite consumers with the willingness and ability to buy the product at a certain price, and infinite producers with the willingness and ability to supply the product at a certain price.

2. Zero entry and exit barriers – It is relatively easy for a business to enter or exit in a perfectly competitive market.

3. Perfect factor mobility - In the long run factors of production are perfectly mobile allowing free long term adjustments to changing market conditions. Perfect information - Prices and quality of products are assumed to be known to all consumers and producers.

4. Zero transaction costs - Buyers and sellers incur no costs in making an exchange (perfect mobility).

5. Profit maximization - Firms aim to sell where marginal costs meet marginal revenue, where they generate the most profit.

6. Homogeneous products – The characteristics of any given market good or service do not vary across suppliers.

7. Non-increasing returns to scale - Non-increasing returns to scale ensure that there are sufficient firms in the industry.

http://en.wikipedia.org/wiki/Perfect_competition

Generally, a perfectly competitive market exists when every participant is a "price taker", and no participant influences the price of the product it buys or sells. Specific characteristics may include:

1. Infinite buyers and sellers – Infinite consumers with the willingness and ability to buy the product at a certain price, and infinite producers with the willingness and ability to supply the product at a certain price.

2. Zero entry and exit barriers – It is relatively easy for a business to enter or exit in a perfectly competitive market.

3. Perfect factor mobility - In the long run factors of production are perfectly mobile allowing free long term adjustments to changing market conditions. Perfect information - Prices and quality of products are assumed to be known to all consumers and producers.

4. Zero transaction costs - Buyers and sellers incur no costs in making an exchange (perfect mobility).

5. Profit maximization - Firms aim to sell where marginal costs meet marginal revenue, where they generate the most profit.

6. Homogeneous products – The characteristics of any given market good or service do not vary across suppliers.

7. Non-increasing returns to scale - Non-increasing returns to scale ensure that there are sufficient firms in the industry.

http://en.wikipedia.org/wiki/Perfect_competition

Market Failure

Mainstream economic analysis widely accepts a market failure (relative to Pareto efficiency) can occur for three main reasons:

if the market is "monopolised" or a small group of businesses hold significant market power,

if production of the good or service results in an externality, or

if the good or service is a "public good".

http://en.wikipedia.org/wiki/Market_failure

http://www.iser.osaka-u.ac.jp/~saijo/lec/micro/02/lec-note.pdf

if the market is "monopolised" or a small group of businesses hold significant market power,

if production of the good or service results in an externality, or

if the good or service is a "public good".

http://en.wikipedia.org/wiki/Market_failure

http://www.iser.osaka-u.ac.jp/~saijo/lec/micro/02/lec-note.pdf

2012年5月17日木曜日

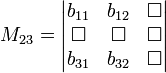

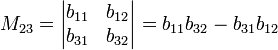

Inverse of A (matrix): Analytical Solution

where C(i,j) is the cofactor of A(i,j) such that

M(i,j) is defined to be the determinant of the submatrix obtained by removing from A its i-th row and j-th column. For example,

yields

http://en.wikipedia.org/wiki/Cramer%27s_rule

http://en.wikipedia.org/wiki/Invertible_matrix#Methods_of_matrix_inversion

http://en.wikipedia.org/wiki/Matrix_of_cofactors

Convex Function ⇔ Positive Semidefinite etc.

Let f (x) be a twice differentiable function in n variables defined on an open convex set S. Then we have:

1. f''(x) is positive semidefinite for all x ∈ S ⇔ f is convex in S

2. f''(x) is negative semidefinite for all x ∈ S ⇔ f is concave in S

3. f''(x) is positive definite for all x ∈ S ⇔ f is strictly convex in S

4. f''(x) is negative definite for all x ∈ S ⇔ f is strictly concave in S

http://home.bi.no/a0710194/Teaching/BI-Mathematics/GRA-6035/2010/lecture5-hand.pdf

1. f''(x) is positive semidefinite for all x ∈ S ⇔ f is convex in S

2. f''(x) is negative semidefinite for all x ∈ S ⇔ f is concave in S

3. f''(x) is positive definite for all x ∈ S ⇔ f is strictly convex in S

4. f''(x) is negative definite for all x ∈ S ⇔ f is strictly concave in S

http://home.bi.no/a0710194/Teaching/BI-Mathematics/GRA-6035/2010/lecture5-hand.pdf

Extremum Value Theorem

If an objective function is continuous and its domain is compact, there exists the global max and min points.

http://en.wikipedia.org/wiki/Extreme_value_theorem

http://en.wikipedia.org/wiki/Extreme_value_theorem

2012年5月15日火曜日

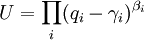

Stone-Geary Utility Function/ Linear Expenditure System

Stone-Geary Utility Function

http://www.ier.hit-u.ac.jp/~kitamura/lecture/Hit/02Statsys4_c.pdf

http://www.ier.hit-u.ac.jp/~kitamura/lecture/Hit/02Statsys4_c.pdf

Cournot/ Engel Aggregation

While these results may look like meaningless mathematics exercises, they are in fact useful for empirical work.

http://faculty.apec.umn.edu/pglewwe/documents/Ap840301.pdf

http://faculty.apec.umn.edu/pglewwe/documents/Ap840301.pdf

Comparative statics

In economics, comparative statics is the comparison of two different economic outcomes, before and after a change in some underlying exogenous parameter.

http://en.wikipedia.org/wiki/Comparative_statics

http://en.wikipedia.org/wiki/Comparative_statics

2012年5月14日月曜日

Special Markov Chain (IID Case)

Let P be the transition matrix of the two state Markov chain, where

p11=1-a, p12=a, p21=b, p22=1-b. In other words,

If a=1-b, then the state X1, X2, ... are independently identically distributed random variables with P{Xn=0}=b and P{Xn=1}=a.

http://www.rslabntu.net/Random_Processes/Chapter_2.pdf

p11=1-a, p12=a, p21=b, p22=1-b. In other words,

If a=1-b, then the state X1, X2, ... are independently identically distributed random variables with P{Xn=0}=b and P{Xn=1}=a.

http://www.rslabntu.net/Random_Processes/Chapter_2.pdf

2012年5月8日火曜日

Negishi Method to Compute Competitive Equilibria

1. Solve the social planners problem for Pareto efficient allocations indexed

by Pareto weight α

2. Compute transfers, indexed by α , necessary to make the efficient allocation

affordable. As prices use Lagrange multipliers on the resource constraints

in the planner's ’problem.

3. Find the Pareto weight(s) α^ that makes the transfer functions 0.

4. The Pareto efficient allocations corresponding to α^ are equilibrium allocations; the supporting equilibrium prices are (multiples of) the Lagrange multipliers from the planning problem.

Dirk Krueger "Macroeconomic Theory" p.17

http://citeseer.ist.psu.edu/viewdoc/download?doi=10.1.1.201.7768&rep=rep1&type=pdf

by Pareto weight α

2. Compute transfers, indexed by α , necessary to make the efficient allocation

affordable. As prices use Lagrange multipliers on the resource constraints

in the planner's ’problem.

3. Find the Pareto weight(s) α^ that makes the transfer functions 0.

4. The Pareto efficient allocations corresponding to α^ are equilibrium allocations; the supporting equilibrium prices are (multiples of) the Lagrange multipliers from the planning problem.

Dirk Krueger "Macroeconomic Theory" p.17

http://citeseer.ist.psu.edu/viewdoc/download?doi=10.1.1.201.7768&rep=rep1&type=pdf

2012年5月7日月曜日

Competitive Equilibrium (Stokey-Lucas)

An allocation [(xi0), (yj0)] together with a continuous linear functional φ: S → R is a competitive equilibrium if

(E1) [(xi0), (yj0)] is feasible;

(E2) for each i, x ∈ Xi and φ(x) ≤ φ(xi0) implies ui(x) ≤ ui(xi0); and

(E3) for each j, y ∈ Yj implies φ(y) ≤ φ(yj0).

Stokey, Lucas "Recursive Methods in Economic Dynamics" p.453

(E1) [(xi0), (yj0)] is feasible;

(E2) for each i, x ∈ Xi and φ(x) ≤ φ(xi0) implies ui(x) ≤ ui(xi0); and

(E3) for each j, y ∈ Yj implies φ(y) ≤ φ(yj0).

Stokey, Lucas "Recursive Methods in Economic Dynamics" p.453

Pareto Optimality (Stokey-Lucas)

Definition (Allocation)

An (I+J)-tuple [(xi),(yj)] describing the consumption xi of each consumer and the production yj of each firm is an allocation for the economy.

Definition (Feasible Allocation)

An allocation is feasible if xi ∈ Xi, all i; yj ∈ Yj, all j; and Σxi - Σyj =0.

Definition (Pareto Optimality)

An allocation [(xi), (yj)] is Pareto optimal if it is feasible and if there is no other feasible allocation [(xi'), (yj')] such that ui(xi') ≥ ui(xi), all i; ui(xi') > ui(xi), some i.

Stokey, Lucas "Recursive Methods in Economic Dynamics," p.453

An (I+J)-tuple [(xi),(yj)] describing the consumption xi of each consumer and the production yj of each firm is an allocation for the economy.

Definition (Feasible Allocation)

An allocation is feasible if xi ∈ Xi, all i; yj ∈ Yj, all j; and Σxi - Σyj =0.

Definition (Pareto Optimality)

An allocation [(xi), (yj)] is Pareto optimal if it is feasible and if there is no other feasible allocation [(xi'), (yj')] such that ui(xi') ≥ ui(xi), all i; ui(xi') > ui(xi), some i.

Stokey, Lucas "Recursive Methods in Economic Dynamics," p.453

登録:

投稿 (Atom)